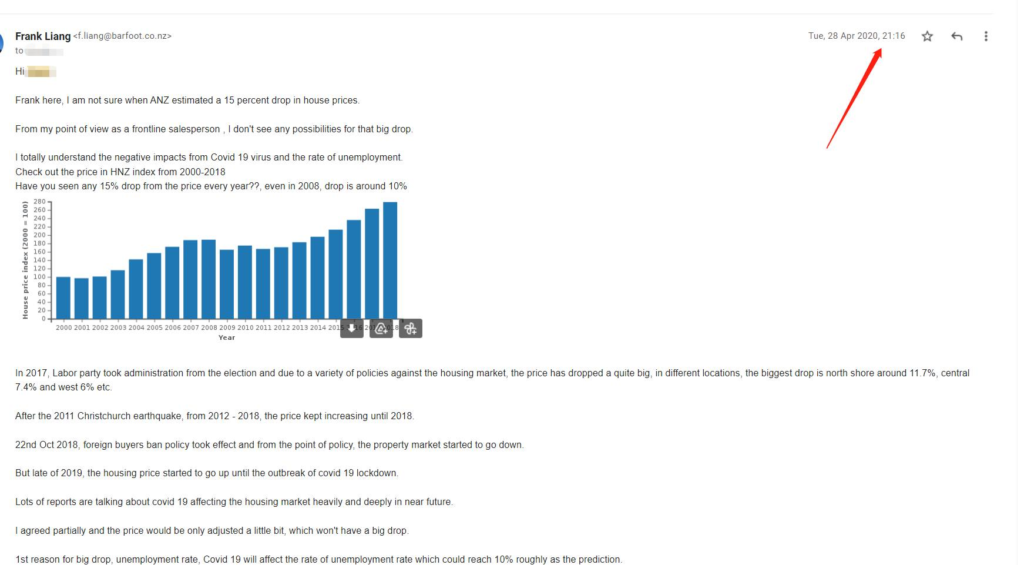

In view of housing market history , most of economists made mistakes due to some reasons below

– The shortage has been created due to labour party policies issued between 2018-2019, which discouraged the developers to start their projects to provide the stock to meet the demand, which is the reason when the price for existing houses are not affordable for certain group of homes buyers, these people have no choice to buy land and house package during 2020-2021 period ( buyers pool was increased dramatically after returning kiwis became a trend)

– NZ was as 3 of zero tolerance on COVID 19 during pandemic, lots of kiwis returned back to NZ ( over 50% returning kiwis decided to stay in Auckland), When buyers and sellers were simultaneously dropped after first lockdown, suddenly the buyers’ pool was increased dramatically while leasing market was also competitive. Lots of people were fighting against each other to get one rental property at that time. Some people with good services while LVR and OCR were dropped decided to purchase a house instead of renting a house (including returning kiwis bought the house during the period)

– Labour party tried to avoid the economic recession by cutting LVR and OCR while QE was in place. As I remember, deposit interest rate was under 1%. The people decided to do the investment during that time against the inflation. Because land and house package were sold successfully while brand new townhouses reached over 800k (2 bedrooms) & freestanding townhouses easily reached over 1m. Some amateur developers decided to invest their money in building sector which boosted the subdivide able sections sold at the incredible price (Although some sections were not subdivide able or at least subdivide able with great costs. Due to high demand on building materials, in 2021, the developers had to wait for materials over months or paid 1.5 or 2 times of normal prices on building materials, nearly every 3-4 months, building materials suppliers increased their price accordingly.

– Although Labour party changed the bright test again on 27th MARCH 2021, it only delayed the market for 2-3 months. Market became crazier under FOMO after Jun 2021, especially second lockdown were in place in mid of August, people learnt the lesson from the first lockdown and the people were fighting against each other fiercely until late of Oct 2021 (DTI was introduced accordingly and low deposit percentage were cut 10%). Until CCCFA were introduced in mid of Dec 2021, market has been changed accordingly because it is hard for people to get the loan (some amateur developers bought the sections with late settlement can’t settle and they lost the deposits, it is easy to read the news like this in 2022. Apparently, people could feel the downturn market on April 2022 after all preapproval granted before CCCFA were spent or voided.)

Basically, in current situation, it is totally different from Covid 19 period, and it is not housing issue anymore.

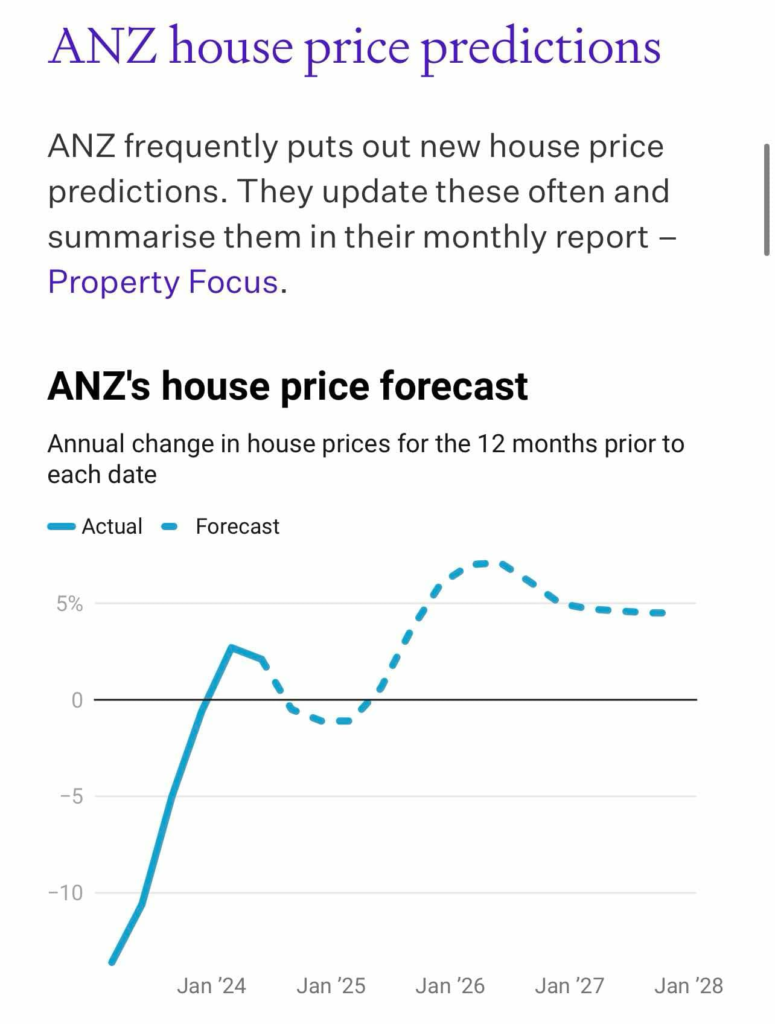

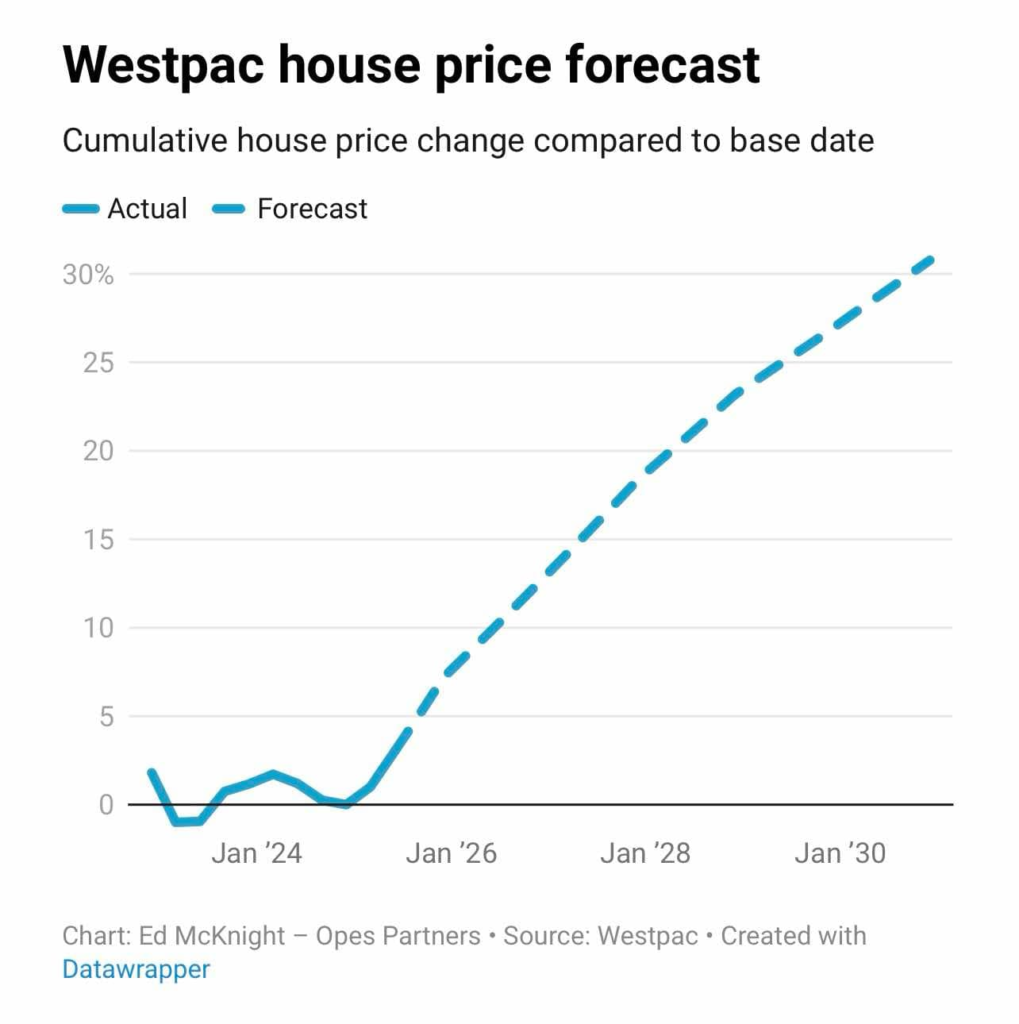

It is economic issue. Although OCR was cut last August, and it has been cut a couple of times. But the market is not getting better and to some extent, it is getting worse in some period.

Trade War from Trump will mess up the supply chain for all over the world. But to some extent, it might be the opportunity for NZ to find the new trade partners.

Who are New Zealand’s top 5 trade partners?

The most common destination for the exports of New Zealand are China ($12.3B), United States ($5.42B), Australia ($5.2B), Japan ($2.62B), and South Korea ($1.37B)

https://oec.world/en/profile/country/nzl

NZ doesn’t need too much share from the surplus America spared and only small portion is good enough for NZ economy recovery.

For example, China has stopped to import the products from USA and Brazil straightaway exported 240 tons bean to China and both of parties are negotiating on other agricultural products accordingly. Vietname has signed the couple of treaty agreements with China. EU has clearly announced EU won’t decouple with China which America asked.

China has notified 193 countries China won’t tolerate any deals to damage China’s Interest on conditions that countries could make deal with USA.

In this Chaos situation, NZ has the special position as one of safest countries in the world which is the reason returning kiwis were back to NZ during pandemic.

During covid 19, we have the population influx and but now we are losing people to Australia which has stopped taking immigrants and tightened up the immigration policies, which is also the reason housing market is slowly recovered.

In the meantime, we have too many houses for sale, especially for townhouses in the market. We have over 40,000 houses for NZ which creates the temporary imbalance between demand and supply which will be reduced accordingly within 6 months or 1 year.

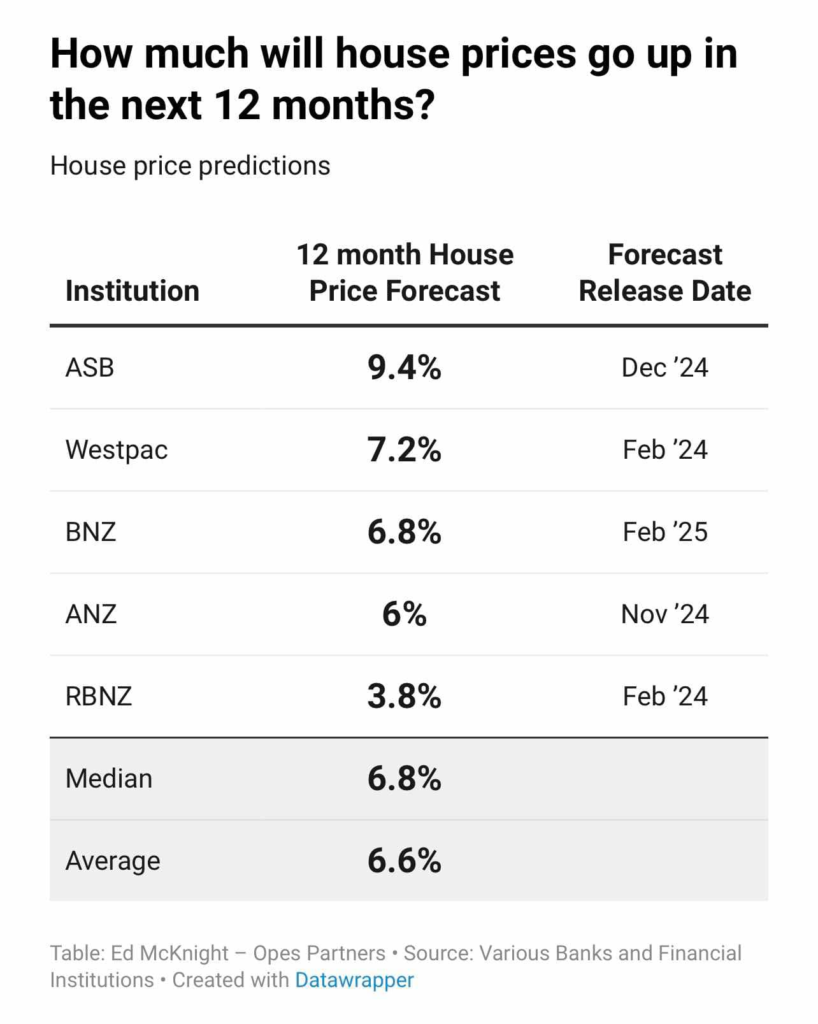

CPI is 2.5%, most likely RBNZ might cut the OCR again in May and retail interest rate is 4.99% for 1 year, 18 months and 2 years.

Retail interest might reach 4.5% even lower by end of this year.

From 1st 2025, interest deductibility became 100% and it might bring more investors in. Especially USA bond, stock and currency market is getting lower and lower. Capital might look for the new area to invest their money and NZ real estate might become one of investment resorts.

Some people worry about trade war, it is not really matter at moment and America won’t win this game. Trump has compromised and plan to reduce the tariff to made in China products yesterday.

When the world is in chaos, NZ might be one of the places people would like to move to.

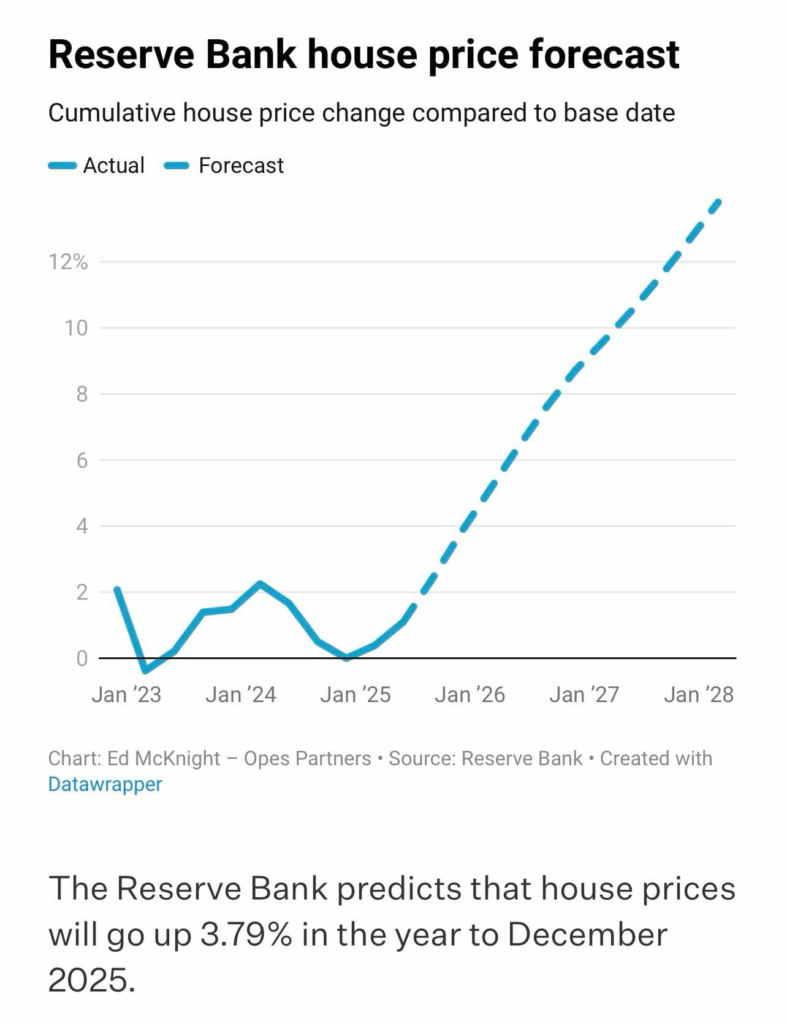

In this post pandemic period, less developers would build more houses and, in the meantime, council plan to increase the contributions and the shortage is predictable within 2 – 3 years.

Any incidents would be happening like 2020-2021, market would be lifted accordingly. But this time, it might become more serious than before.

Labour party gave 160,000 one off immigrants who should have their residency visa already. When the affordability is released for them, and they would become the buyers instantly.

Small portion of the pool of immigrants would put the woods into the spark which will result in the big fire again.

As the first home buyers, you should consider to buy asap before you would regret in 2027-2028.

Recent Comments